Resp Brochure

Resp Brochure - Whether it’s your own child, your niece or nephew, a family friend, or even yourself, an resp helps address the costs of higher education. Contributions to an resp aren’t tax deductible or. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. It ofers tax advantages and government grants that help. Ways to access the information. Click the link below to download our rdsp brochure: Rdsp brochure the government of canada created the rdsp (registered disability savings plan) as a savings plan to help. An resp is the cornerstone of most education savings strategies. If you’re looking for more comprehensive. Which resp is right for you. Ways to access the information. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. A subscriber and/or joint subscriber (must be the spouse or common. At least 30% of your contributions will be matched in government grants paid into the resp. Resps allow parents or other individuals (subscribers) to contribute a certain amount of money into an resp on behalf of a child (beneficiary), and the benefits are. Rc4092 registered education savings plans (resp) this page provides information for individuals on resps. Click the link below to download our rdsp brochure: Which resp is right for you. An resp is an education savings account that helps you, your family or your friends save early for a child’s education after high school. What’s a registered education savings plan (resp)? Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. Rdsp brochure the government of canada created the rdsp (registered disability savings plan) as a savings plan to help. It ofers tax advantages and government grants that help. If you’re looking for more comprehensive. A subscriber and/or joint. What’s a registered education savings plan (resp)? Contributions to an resp aren’t tax deductible or. Whether it’s your own child, your niece or nephew, a family friend, or even yourself, an resp helps address the costs of higher education. Which resp is right for you. It ofers tax advantages and government grants that help. Rdsp brochure the government of canada created the rdsp (registered disability savings plan) as a savings plan to help. Contributions to an resp aren’t tax deductible or. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. It ofers tax advantages and government grants that help. A subscriber. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. At least 30% of your contributions will be matched in government grants paid into the resp. It ofers tax advantages and government grants that help. Which resp is right for you. Ways to access the information. If you’re looking for more comprehensive. Rc4092 registered education savings plans (resp) this page provides information for individuals on resps. Resps allow parents or other individuals (subscribers) to contribute a certain amount of money into an resp on behalf of a child (beneficiary), and the benefits are. Learn how an resp works, educations savings programs, contributing to an resp, payments. Rc4092 registered education savings plans (resp) this page provides information for individuals on resps. Ways to access the information. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. At least 30% of your contributions will be matched in government grants paid into the resp. Whether it’s your. Ways to access the information. Which resp is right for you. Rc4092 registered education savings plans (resp) this page provides information for individuals on resps. What’s a registered education savings plan (resp)? If you’re looking for more comprehensive. Ways to access the information. Whether it’s your own child, your niece or nephew, a family friend, or even yourself, an resp helps address the costs of higher education. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply. Click the link below to download our rdsp brochure:. Which resp is right for you. An resp is an education savings account that helps you, your family or your friends save early for a child’s education after high school. Ways to access the information. At least 30% of your contributions will be matched in government grants paid into the resp. Whether it’s your own child, your niece or nephew,. Contributions to an resp aren’t tax deductible or. Resps allow parents or other individuals (subscribers) to contribute a certain amount of money into an resp on behalf of a child (beneficiary), and the benefits are. At least 30% of your contributions will be matched in government grants paid into the resp. Click the link below to download our rdsp brochure:. Rdsp brochure the government of canada created the rdsp (registered disability savings plan) as a savings plan to help. What’s a registered education savings plan (resp)? Ways to access the information. Whether it’s your own child, your niece or nephew, a family friend, or even yourself, an resp helps address the costs of higher education. At least 30% of your contributions will be matched in government grants paid into the resp. An resp is an education savings account that helps you, your family or your friends save early for a child’s education after high school. If you’re looking for more comprehensive. Click the link below to download our rdsp brochure: A subscriber and/or joint subscriber (must be the spouse or common. Rc4092 registered education savings plans (resp) this page provides information for individuals on resps. Which resp is right for you. Learn how an resp works, educations savings programs, contributing to an resp, payments from an resp, and the special rules which apply.Respiratory Therapy St. Mary's Health & Clearwater Valley Health

Respiratory rehabilitation and recovery brochure template. Flyer

Pamphlets and Brochures Sunrise Swag

brochure_respiratorytherapy_letter PPT Free Download

Respiratory recovery blue and yellow brochure template. Flyer, booklet

Respiratory Therapy St. Mary's Health & Clearwater Valley Health

Respiratory System brochure flyer design template with abstract photo

Respiratory Vectors & Illustrations for Free Download Freepik Free

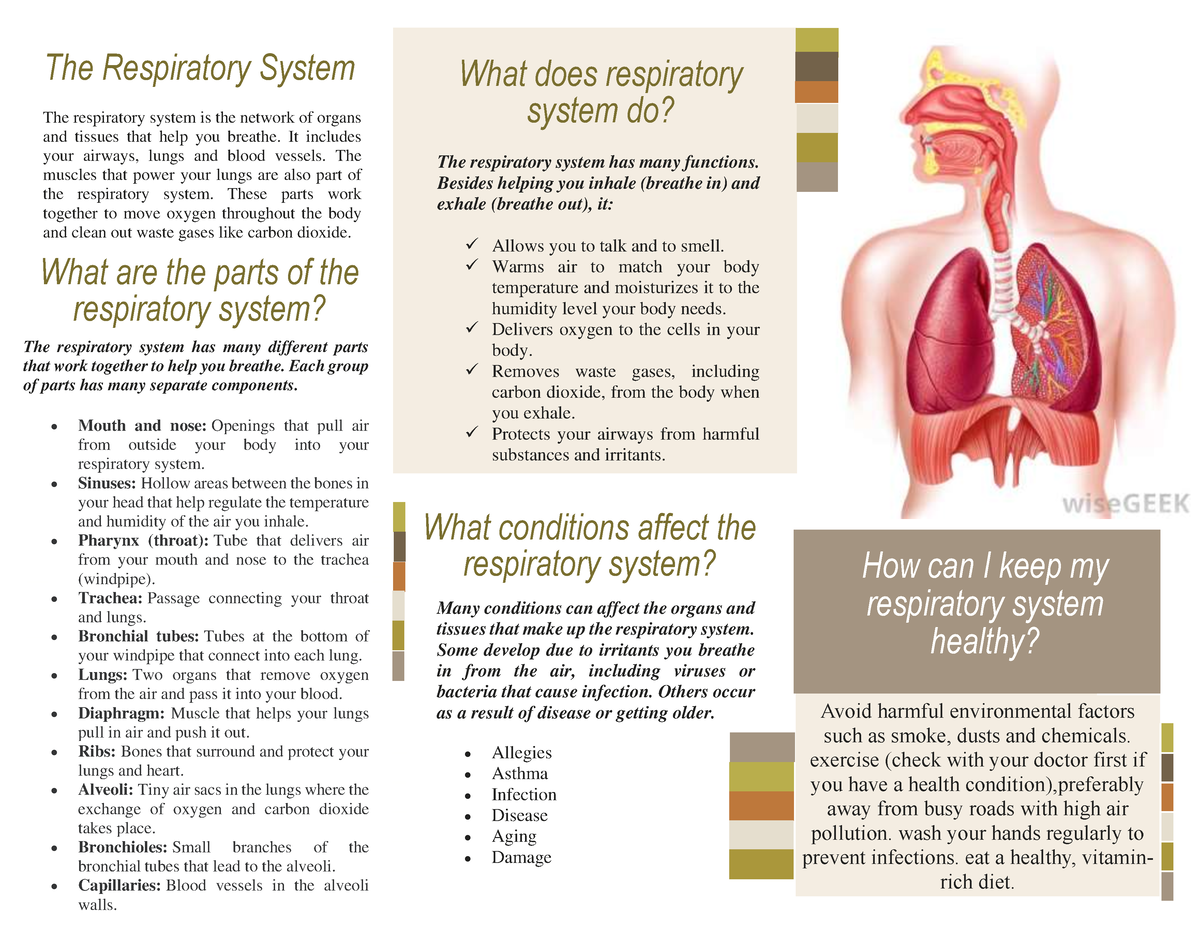

Consigna Medical Brochure Respiratory System The respiratory system

Respiratory_system_Digital_Brochuure.pdf

An Resp Is The Cornerstone Of Most Education Savings Strategies.

Contributions To An Resp Aren’t Tax Deductible Or.

It Ofers Tax Advantages And Government Grants That Help.

Resps Allow Parents Or Other Individuals (Subscribers) To Contribute A Certain Amount Of Money Into An Resp On Behalf Of A Child (Beneficiary), And The Benefits Are.

Related Post: