Ncua Insurance Brochure

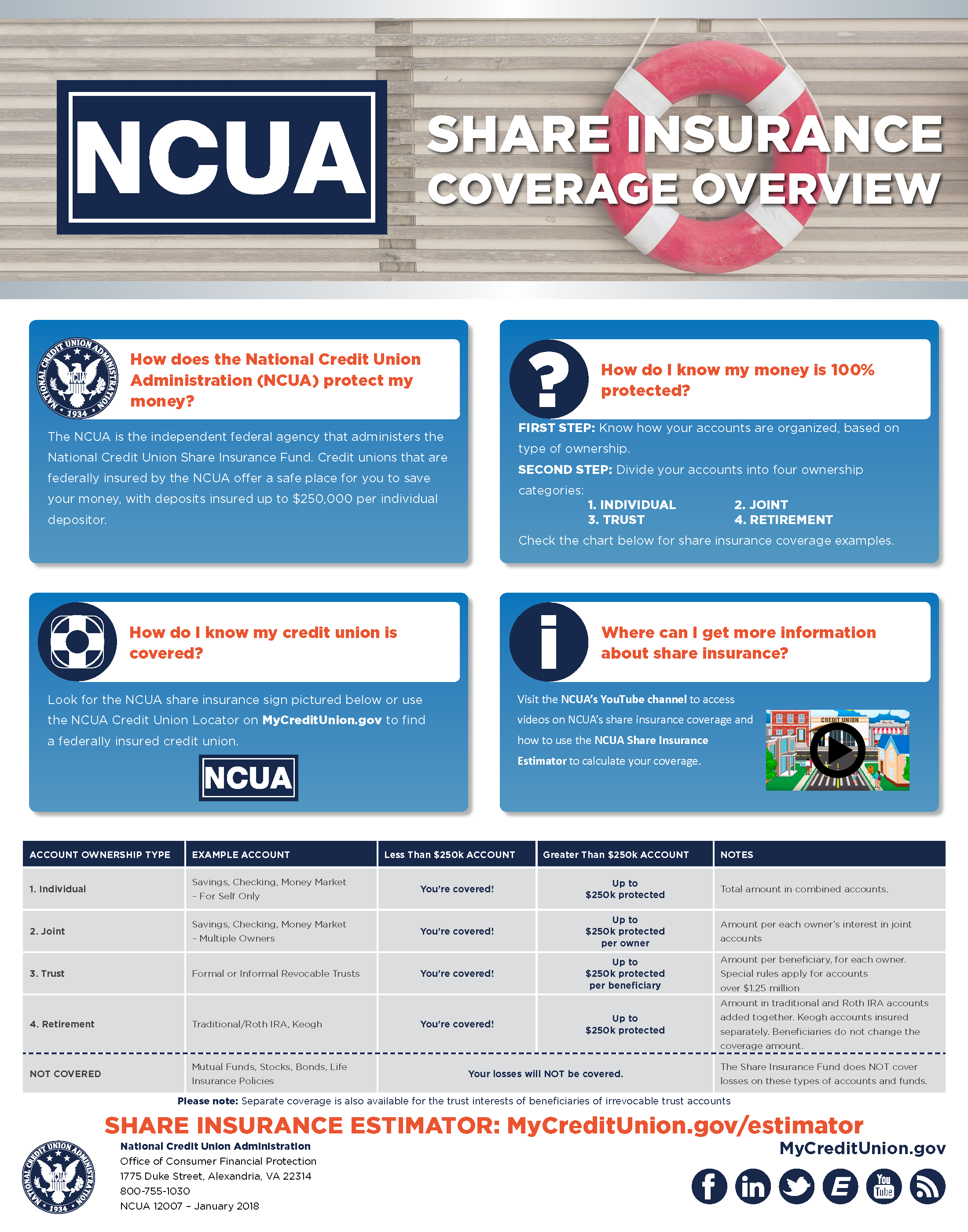

Ncua Insurance Brochure - The ncua’s rules and regulations allow credit union members to comment on the proposed merger of two federally insured credit unions. The standard share insurance amount is $250,000 per share owner, per insured. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. Check out our website to learn about regulations and ncua insurance. Credit unions that are federally insured by the ncua offer a. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. Because the scope of this brochure is limited, credit union. View or download one of the ncua share insurance resources and learn how the ncua protects your money. How can i get more information?. To submit comments, find your. Educate your members about ncua's share insurance coverage with these professionally designed brochures. Credit union members can download, view, and print the following brochures, which are available in english and spanish, for more information about. Because the scope of this brochure is limited, credit union. Check out our website to learn about regulations and ncua insurance. Because the scope of this brochure is limited, credit union. The standard share insurance amount is $250,000 per share owner, per insured. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. How can i get more information?. A brochure entitled your insured funds is available at ncua’s internet site this comprehensive brochure contains a detailed discussion of all available types of coverage offered by the. The ncua’s rules and regulations allow credit union members to comment on the proposed merger of two federally insured credit unions. All federal credit unions must be. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. Educate your members about ncua's share insurance coverage with these professionally designed brochures. The standard share insurance amount is $250,000 per share owner, per insured. Federally insured credit unions are required to indicate their insured status in their advertising. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. Because the scope of this brochure is limited, credit union. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. Insurance purposes and insured for a total of $250,000 that is separate. Check out our website to learn about regulations and ncua insurance. Credit unions that are insured by the ncusif must display in their offices the official ncua insurance sign, which appears on the cover of this booklet. How can i get more information?. The ncua is the independent federal agency that administers the national credit union share insurance fund. Enjoy. Because the scope of this brochure is limited, credit union. The ncua is the independent federal agency that. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. Enjoy quick access to healthcare associates credit union's disclosure agreements. The standard share insurance amount. To submit comments, find your. How can i get more information?. Credit union members can download, view, and print the following brochures, which are available in english and spanish, for more information about. The ncua is the independent federal agency that administers the national credit union share insurance fund. How does the national credit union administration (ncua) protect my money? The ncua’s rules and regulations allow credit union members to comment on the proposed merger of two federally insured credit unions. How can i get more information?. Educate your members about ncua's share insurance coverage with these professionally designed brochures. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. All federal credit unions must be. The ncua’s rules and regulations allow credit union members to comment on the proposed merger of. View or download one of the ncua share insurance resources and learn how the ncua protects your money. Enjoy quick access to healthcare associates credit union's disclosure agreements. The ncua is the independent federal agency that. Educate your members about ncua's share insurance coverage with these professionally designed brochures. This brochure provides examples of insurance coverage under the national credit. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. Consumer related brochures and publications on. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. This brochure provides examples of insurance coverage under the national credit union. Educate your members about ncua's share insurance coverage with these professionally designed brochures. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. The ncua’s rules and regulations allow credit union members to comment on the proposed merger of two federally insured credit unions. To submit comments, find your. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. The ncua is the independent federal agency that administers the national credit union share insurance fund. View or download one of the ncua share insurance resources and learn how the ncua protects your money. How can i get more information?. Because the scope of this brochure is limited, credit union. Enjoy quick access to healthcare associates credit union's disclosure agreements. The standard share insurance amount is $250,000 per share owner, per insured. How does the national credit union administration (ncua) protect my money? Credit unions that are federally insured by the ncua offer a. The ncua is the independent federal agency that. All federal credit unions must be.NCUA Share Insurance Brochure Folded 4 Panel Brochure

Your Money is Federally Insured Through the NCUA

Best Practices to Keep Your Money Insured

How Your Accounts Are Federally Insured Hawaiian Financial Federal

How Your Accounts Are Federally Insured Hawaiian Financial Federal

Ncua Magazines

NCUA Brochure for Credit Unions Your Insured Funds

NCUA Booklet Your Insured Funds Pack of 50

NCUA Insurance by Hudson River Community Credit Union Issuu

How Your Accounts Are Federally Insured Hawaiian Financial Federal

A Brochure Entitled Your Insured Funds Is Available At Ncua’s Internet Site This Comprehensive Brochure Contains A Detailed Discussion Of All Available Types Of Coverage Offered By The.

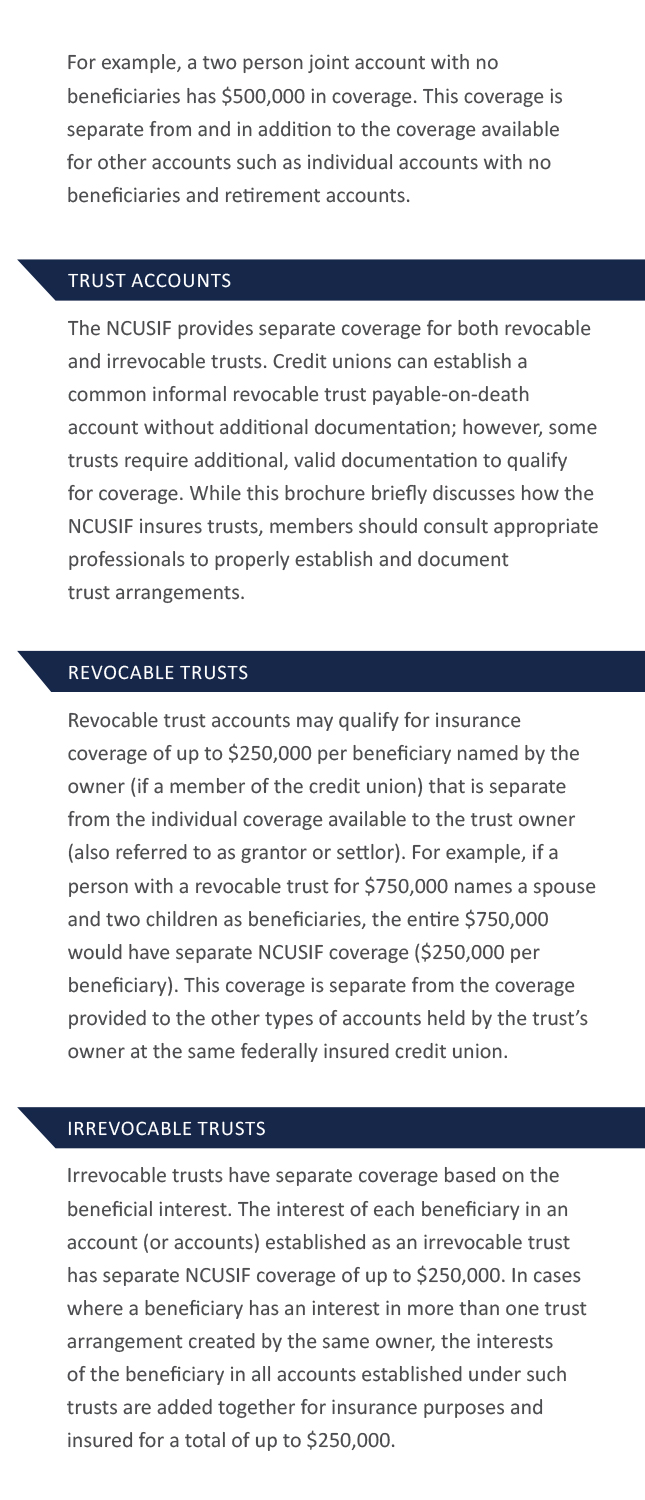

Insurance Purposes And Insured For A Total Of $250,000 That Is Separate From And In Addition To The Coverage The Ncusif Provides For Other Types Of Accounts.

Consumer Related Brochures And Publications On Topics Like Share Insurance Coverage, Financial Literacy And Money Transfers Are Also Available For Download On Ncua’s.

Credit Union Members Can Download, View, And Print The Following Brochures, Which Are Available In English And Spanish, For More Information About.

Related Post: