Collegeamerica 529 Brochure

Collegeamerica 529 Brochure - In july 2001, the board determined to offer collegeamerica, a 529 savings plan sold exclusively through financial professionals. State tax benefitsadvisor guidedtax free growthcompare savings options Section 529 qualified tuition programs are intended to be used only to save for qualified education expenses. Student loan refinanceloan made for your budgetgreat customer service These programs are not intended to be used, nor should they be used,. This program description is designed to comply. This program description incorporates by reference the current prospectuses of american funds available in collegeamerica. Description of the collegeamerica plan that outlines the plan in detail. Investors in collegeamerica will receive the current summary prospectus for the individual american funds selected for their account. For fund numbers, names, minimums and share class. Employer sponsored college savings (529) plan brochure, calculator, and setup instructions Search by title, subject, literature number, fund or cover description. In july 2001, the board determined to offer collegeamerica, a 529 savings plan sold exclusively through financial professionals. (if you do not choose a share class,. Collegeamerica was launched in february 2002. Invest my contributions as instructed below. Investors in collegeamerica will receive the current summary. This program description incorporates by reference the current prospectuses of american funds available in collegeamerica. This program description is designed to comply. Collegeamerica is the nation’s largest 529 savings plan, † with approximately 2.8 million families invested nationwide.* as a matter of fact, our 529 plan has been among. Section 529 qualified tuition programs are intended to be used only to save for qualified education expenses. Invest my contributions as instructed below. Search by title, subject, literature number, fund or cover description. Find information on transacting in and updating a collegeamerica® 529 account at capital group, including how to make a contribution, take a withdraw and update the account. (if you do not choose a share class,. This program description is designed to comply. This program description incorporates by reference the current prospectuses of american funds available in collegeamerica. You must log in to order literature. Investors in collegeamerica will receive the current summary prospectus for the individual american funds selected for their account. Collegeamerica was launched in february 2002. You must log in to order literature. This program description incorporates by reference the current prospectuses of american funds available in collegeamerica. For fund numbers, names, minimums and share class. Collegeamerica is the nation’s largest 529 savings plan, † with approximately 2.8 million families invested nationwide.* as a matter of fact, our 529 plan. Description of the collegeamerica plan that outlines the plan in detail. You must log in to order literature. For fund numbers, names, minimums and share class. This program description incorporates by reference the current prospectuses of american funds available in collegeamerica. Investors in collegeamerica will receive the current summary prospectus for the individual american funds selected for their account. For fund numbers, names, minimums and share class. Find information on transacting in and updating a collegeamerica® 529 account at capital group, including how to make a contribution, take a withdraw and update the account beneficiary. Learn benefits of saving for college tuition and expenses with a collegeamerica 529 savings plan, the nation's largest 529. Investors in collegeamerica will receive. Section 529 qualified tuition programs are intended to be used only to save for qualified education expenses. Find information on transacting in and updating a collegeamerica® 529 account at capital group, including how to make a contribution, take a withdraw and update the account beneficiary. These programs are not intended to be used, nor should they be used,. State tax. Investors in collegeamerica will receive the current summary prospectus for the individual american funds selected for their account. Search by title, subject, literature number, fund or cover description. Section 529 qualified tuition programs are intended to be used only to save for qualified education expenses. Description of the collegeamerica plan that outlines the plan in detail. Learn benefits of saving. Invest my contributions as instructed below. Investors in collegeamerica will receive the current summary prospectus for the individual american funds selected for their account. This brochure highlights the importance of saving for college and outlines american funds' offerings. State tax benefitsadvisor guidedtax free growthcompare savings options Search by title, subject, literature number, fund or cover description. Student loan refinanceloan made for your budgetgreat customer service (if you do not choose a share class,. This program description incorporates by reference the current prospectuses of american funds available in collegeamerica. Collegeamerica was launched in february 2002. Invest my contributions as instructed below. Employer sponsored college savings (529) plan brochure, calculator, and setup instructions Student loan refinanceloan made for your budgetgreat customer service Investors in collegeamerica will receive the current summary. In july 2001, the board determined to offer collegeamerica, a 529 savings plan sold exclusively through financial professionals. You must log in to order literature. Investors in collegeamerica will receive the current summary. These programs are not intended to be used, nor should they be used,. Employer sponsored college savings (529) plan brochure, calculator, and setup instructions For fund numbers, names, minimums and share class. Invest my contributions as instructed below. Collegeamerica is the nation’s largest 529 savings plan, † with approximately 2.8 million families invested nationwide.* as a matter of fact, our 529 plan has been among. State tax benefitsadvisor guidedtax free growthcompare savings options Learn benefits of saving for college tuition and expenses with a collegeamerica 529 savings plan, the nation's largest 529. This program description is designed to comply. Section 529 qualified tuition programs are intended to be used only to save for qualified education expenses. You must log in to order literature. This brochure highlights the importance of saving for college and outlines american funds' offerings. (if you do not choose a share class,. Find information on transacting in and updating a collegeamerica® 529 account at capital group, including how to make a contribution, take a withdraw and update the account beneficiary. In july 2001, the board determined to offer collegeamerica, a 529 savings plan sold exclusively through financial professionals. Description of the collegeamerica plan that outlines the plan in detail.529 savings plan Top 6 things to know Fidelity Arizona education, How to plan, Savings plan

529 College Savings Plan YouTube

The 529 Plan and college savings

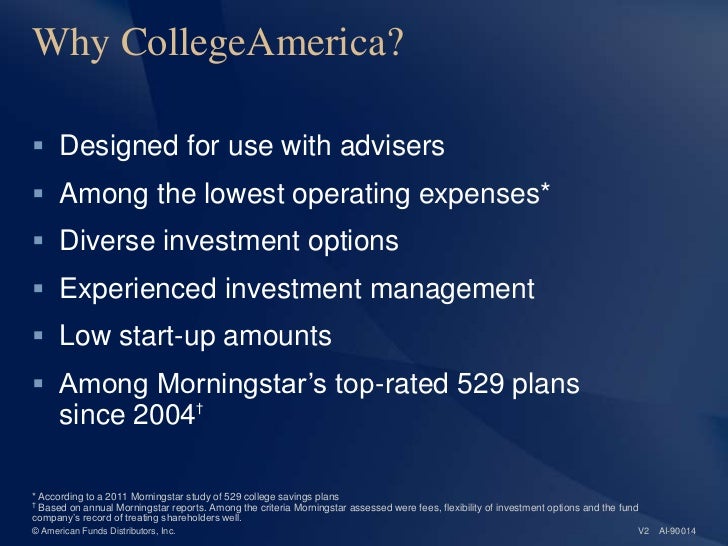

College America 529 Plan

College America 529 Plan

529 College Savings Plans A Cheat Sheet for Common Questions TDECU

Understanding 529 Plans Infographic

Help clients with CollegeAmerica distributions Capital Group

College america 529 Fill out & sign online DocHub

College America 529 Plan

How To Open, Manage And Transact In An American Funds Collegeamerica® 529 Account.

Student Loan Refinanceloan Made For Your Budgetgreat Customer Service

These Programs Are Not Intended To Be Used, Nor Should They Be Used,.

Collegeamerica Was Launched In February 2002.

Related Post: