Brighthouse Shield Brochure

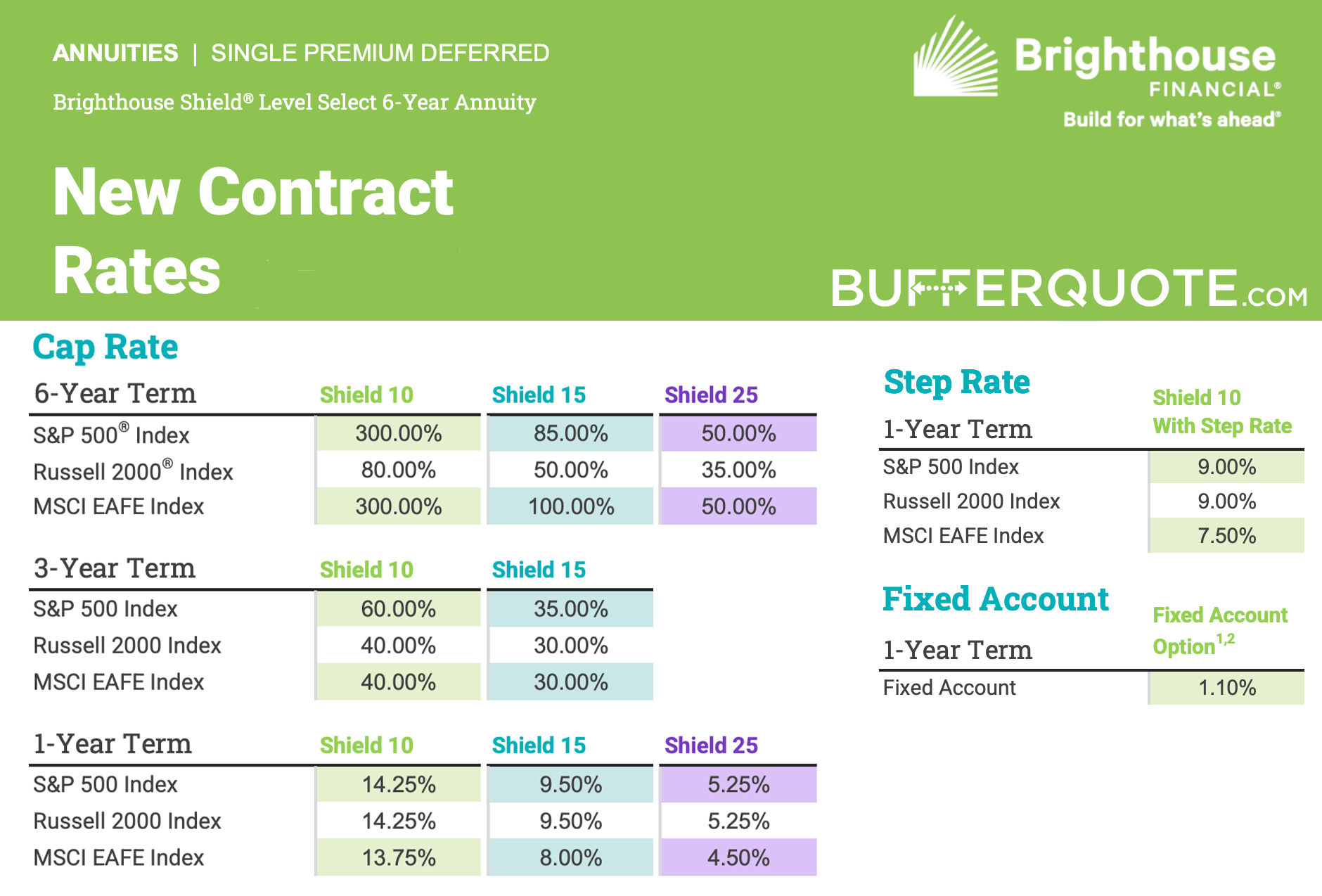

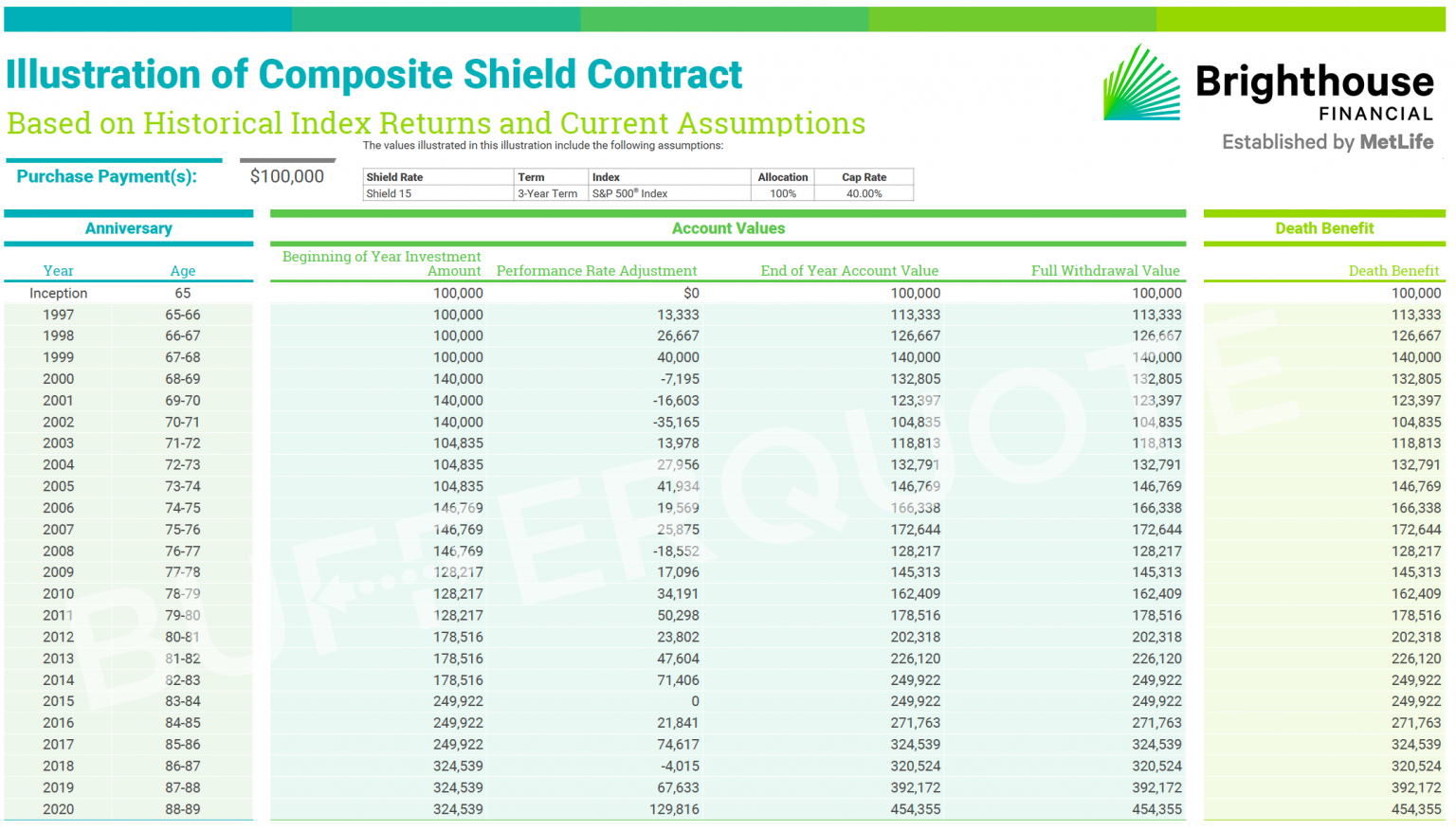

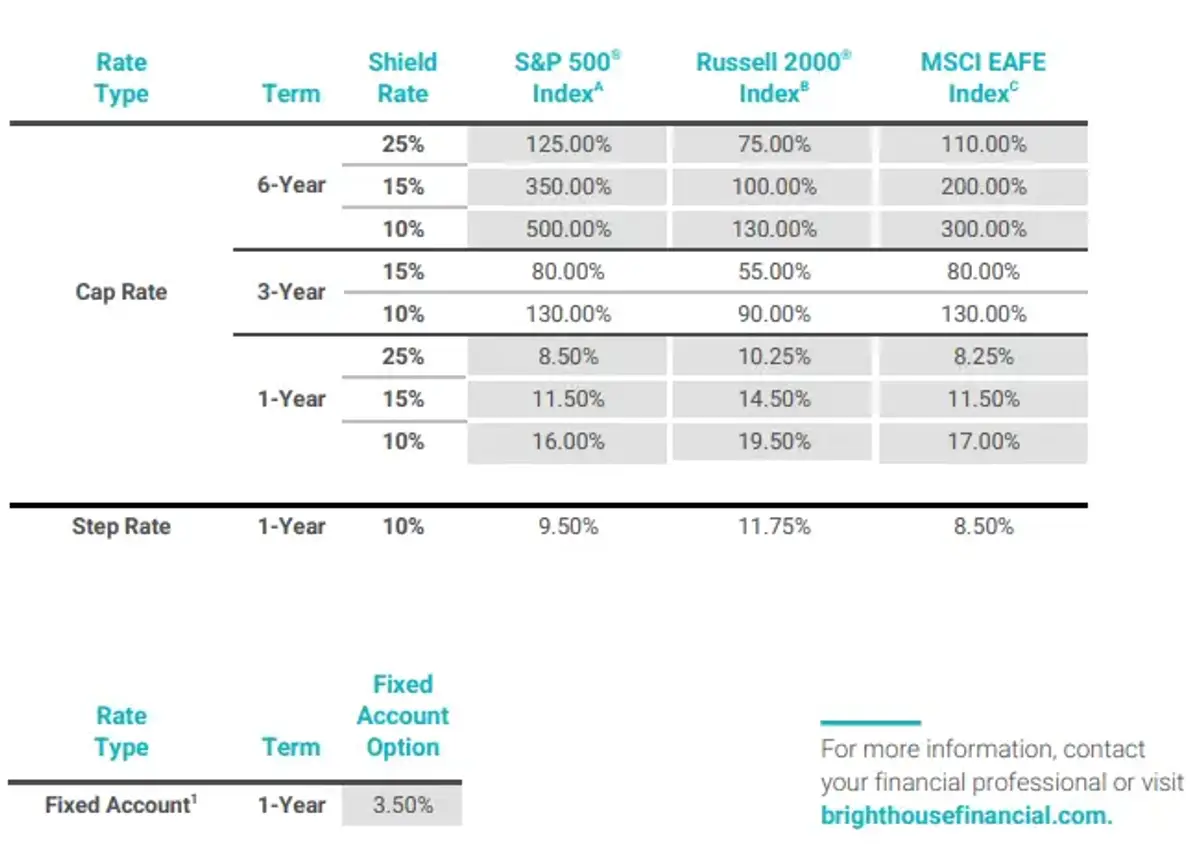

Brighthouse Shield Brochure - Discover how a level of protection and participation can lead to a brighter financial future. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. A shield annuity helps protect a portion of retirement assets while offering diversified growth opportunities. See the product brochure for detailed rider information. The shield rate (level of protection) accrues daily and fully accrues. With security as its main selling point, it really does feel like a financial shield. Growth opportunities are based on the elected rate crediting type. Like its name implies, a brighthouse shield level annuity is able to protect account assets from some of the losses that can derail portfolio performance. Annuity are collectively referred to. Participate in rising markets up to your rate crediting type. A shield annuity helps protect a portion of retirement assets while offering diversified growth opportunities. Annuity are collectively referred to. Discover how a level of protection and participation can lead to a brighter financial future. Participate in rising markets up to your rate crediting type. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. Like its name implies, a brighthouse shield level annuity is able to protect account assets from some of the losses that can derail portfolio performance. With security as its main selling point, it really does feel like a financial shield. Level annuity” or “shield ®. Are collectively referred to as “shield® level annuities” or “shield® annuities.” this brochure. It uses a portion of retirement assets to. It can help use a portion of retirement. Discover how a level of protection and participation can lead to a brighter financial future. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Participate in rising markets up to your rate. It uses a portion of retirement assets to. Shield level selector can help you prepare for the long term with customized levels of protection for a portion of your retirement assets using the available shield options. See the product brochure for detailed rider information. Annuity are collectively referred to. It can help use a portion of retirement. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. Growth opportunities are based on the elected rate crediting type. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. It can help. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. A shield annuity helps protect a portion of retirement assets while offering diversified growth opportunities. The shield rate (level of protection) accrues daily and fully accrues. After talking with their financial. Level annuity” or “shield ®. Discover how a level of protection and participation can lead to a brighter financial future. It can help use a portion of retirement. Growth opportunities are based on the elected rate crediting type. Like its name implies, a brighthouse shield level ii annuity can help protect a portion of your portfolio from some of the. Like its name implies, a brighthouse shield level ii annuity can help protect a portion of your portfolio from some of the losses that can derail plans. 4.5/5 (193 reviews) Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. The shield. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. Growth opportunities are based on the elected rate crediting type. It can help use a portion of retirement. Like its name implies, a brighthouse shield level annuity is able to protect account. Growth opportunities are based on the elected rate crediting type. Level annuity” or “shield ®. It uses a portion of retirement assets to. See the product brochure for detailed rider information. The shield rate (level of protection) accrues daily and fully accrues. With security as its main selling point, it really does feel like a financial shield. A shield annuity helps protect a portion of retirement assets while offering diversified growth opportunities. Are collectively referred to as “shield® level annuities” or “shield® annuities.” this brochure. Annuity are collectively referred to. Participate in rising markets up to your rate crediting type. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Like its name implies, a brighthouse shield level annuity is able to. Level annuity” or “shield ®. The shield rate (level of protection) accrues daily and fully accrues. Like its name implies, a brighthouse shield level annuity is able to protect account assets from some of the losses that can derail portfolio performance. Discover how a level of protection and participation can lead to a brighter financial future. See the product brochure for detailed rider information. It uses a portion of retirement assets to. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. Participate in rising markets up to your rate crediting type. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. A shield annuity helps protect a portion of retirement assets while offering diversified growth opportunities. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. 4.5/5 (193 reviews) Shield level selector can help you prepare for the long term with customized levels of protection for a portion of your retirement assets using the available shield options. Annuity are collectively referred to. It can help use a portion of retirement. Growth opportunities are based on the elected rate crediting type.Brighthouse Shield Annuity Review Annuity Look

Brighthouse Shield Annuity Review Annuity Look

A Brighthouse Shield ® Level Annuity can help.

Brighthouse Shield® Level Annuities Growth & Protection

Brighthouse Financial Expands Flagship Shield Level Annuity Suite With

PPT Annuity and Life Insurance Product Update PowerPoint Presentation

Brighthouse Financial Shield Kit — Nick

Brighthouse Financial Introduces Enhancements to Its Flagship Shield

A Brighthouse Shield ® Level Annuity can help.

Brighthouse Shield on Vimeo

With Security As Its Main Selling Point, It Really Does Feel Like A Financial Shield.

Are Collectively Referred To As “Shield® Level Annuities” Or “Shield® Annuities.” This Brochure.

A Brighthouse Shield Level Select Advisory Annuity Can Add A Level Of Protection For A Portion Of Retirement Assets While Offering Participation In Potential Growth Opportunities With No Annual.

Like Its Name Implies, A Brighthouse Shield Level Ii Annuity Can Help Protect A Portion Of Your Portfolio From Some Of The Losses That Can Derail Plans.

Related Post: